Koodo’s Negligence is Destroying My Credit Score – No Help, No Support!

Hi everyone,

I am beyond frustrated with Koodo and their reckless handling of my credit report. Despite settling my balance in full months ago, Koodo is STILL wrongfully reporting me as a defaulter and tanking my credit score. Here’s what happened:

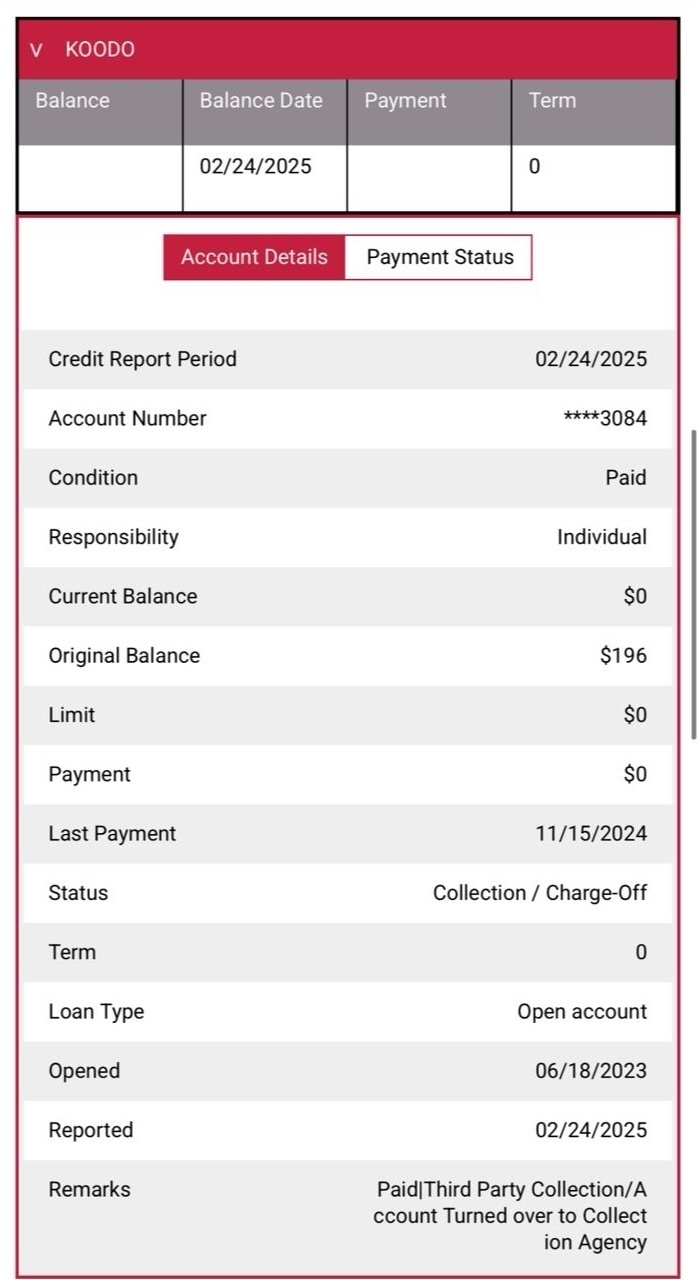

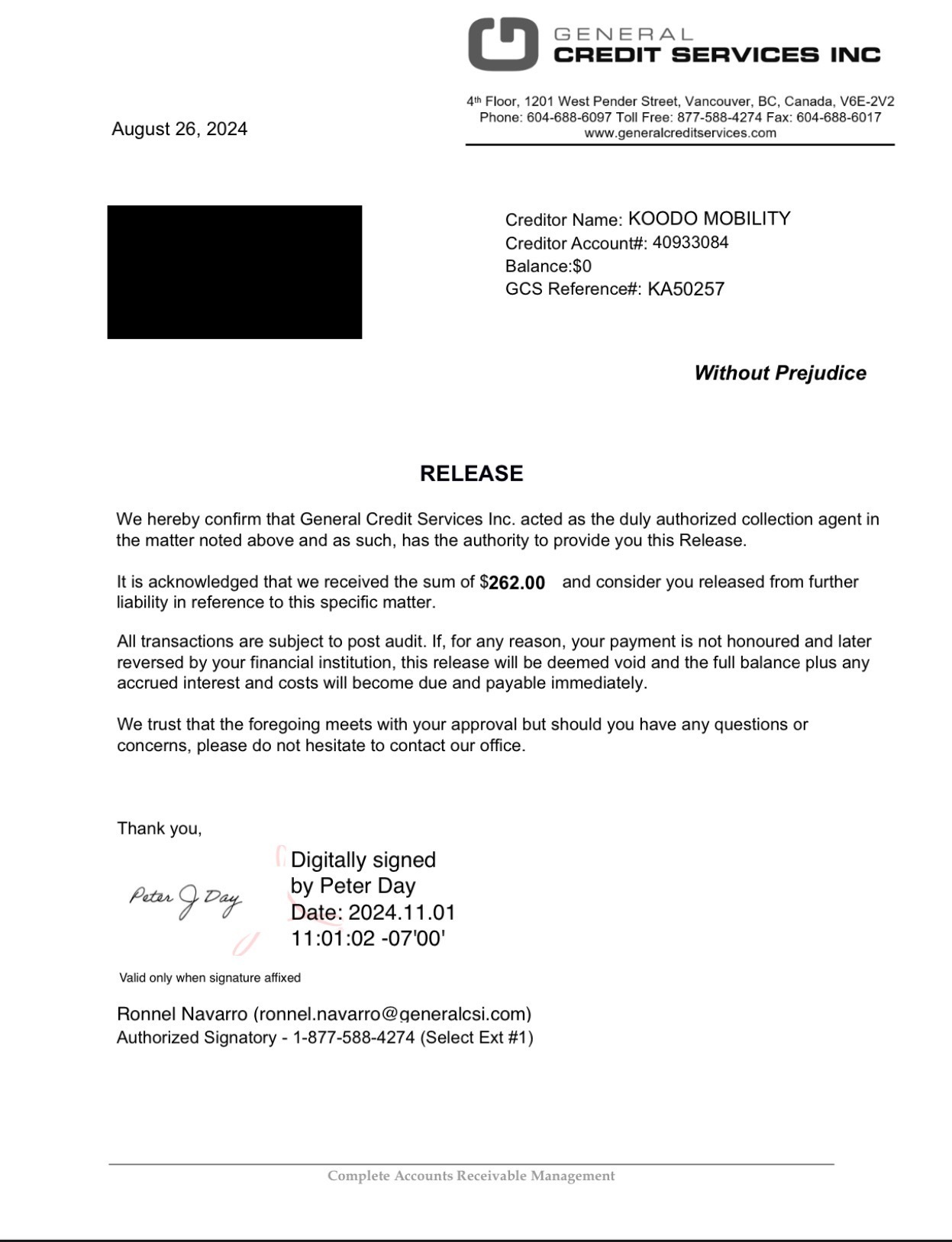

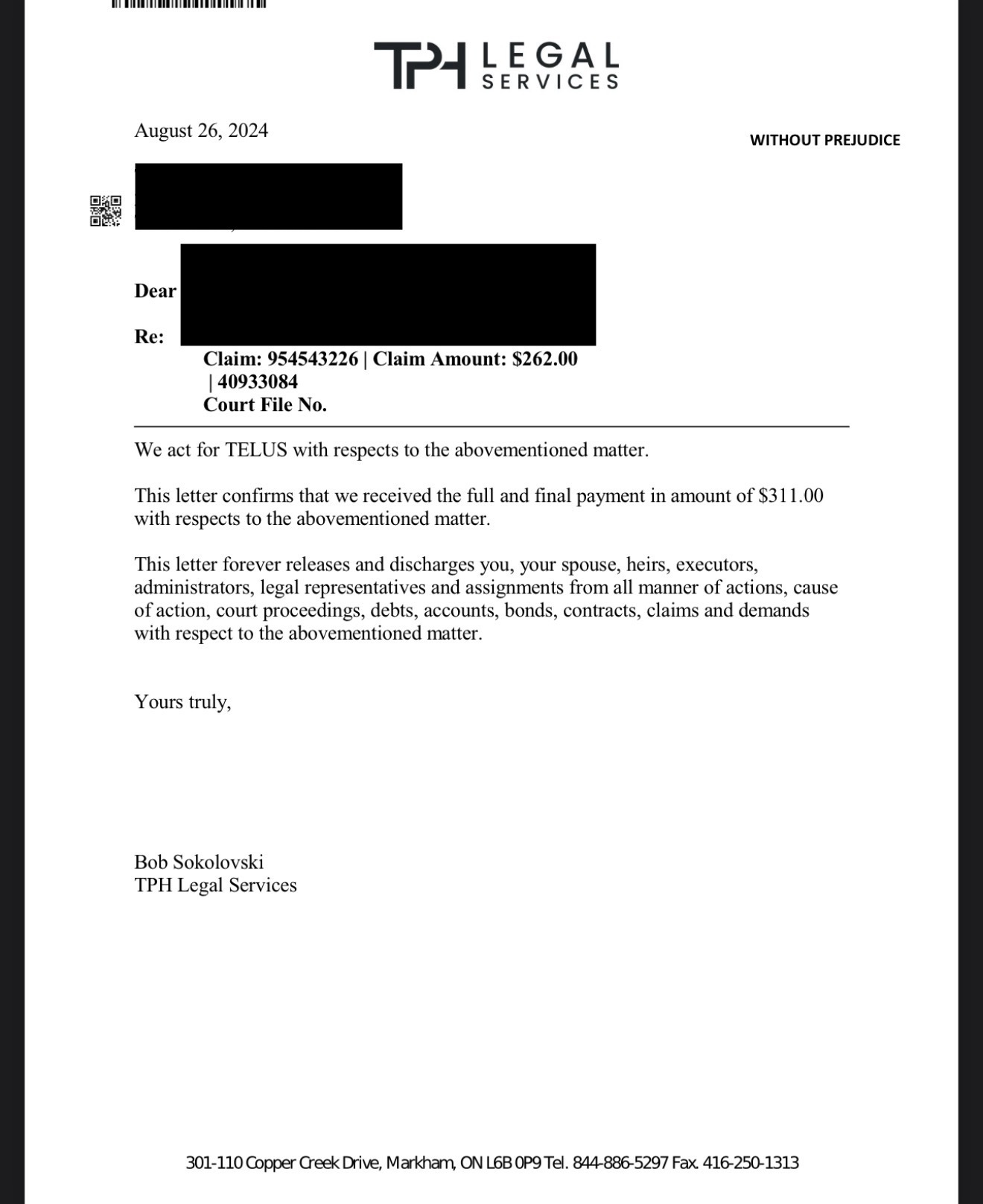

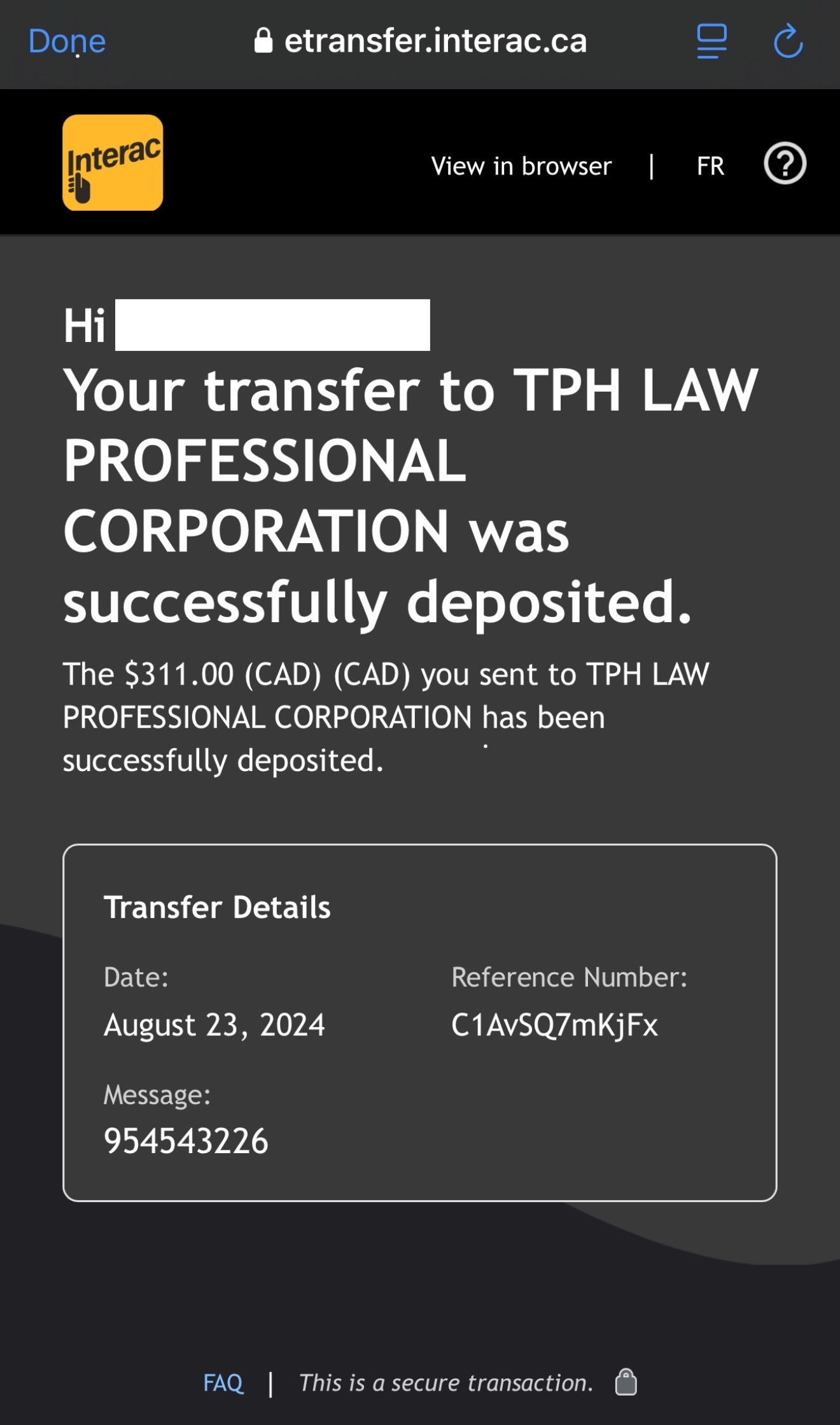

1. My Account Was Fully Paid in August 2024

• I settled my balance in full, with interest, on August 23, 2024.

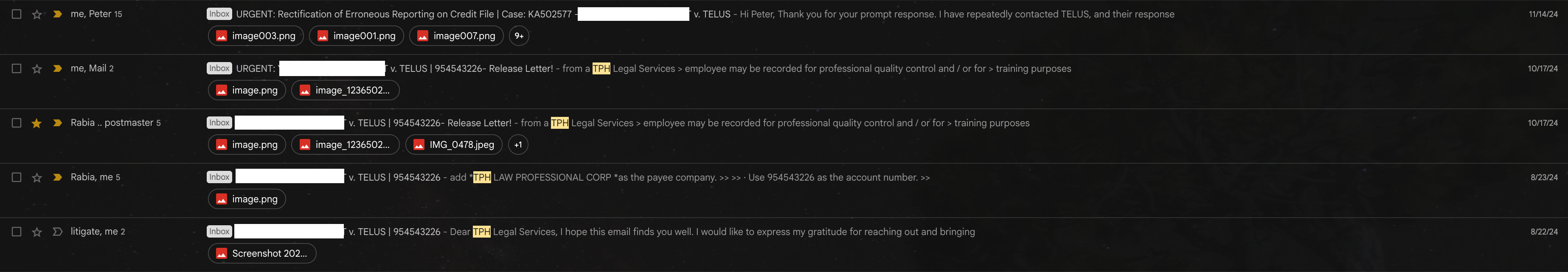

• I received official release letters from two third-party collection agencies confirming that my account was closed.

• There is NO balance due – I owe Koodo $0 yet they continue to report missed payments.

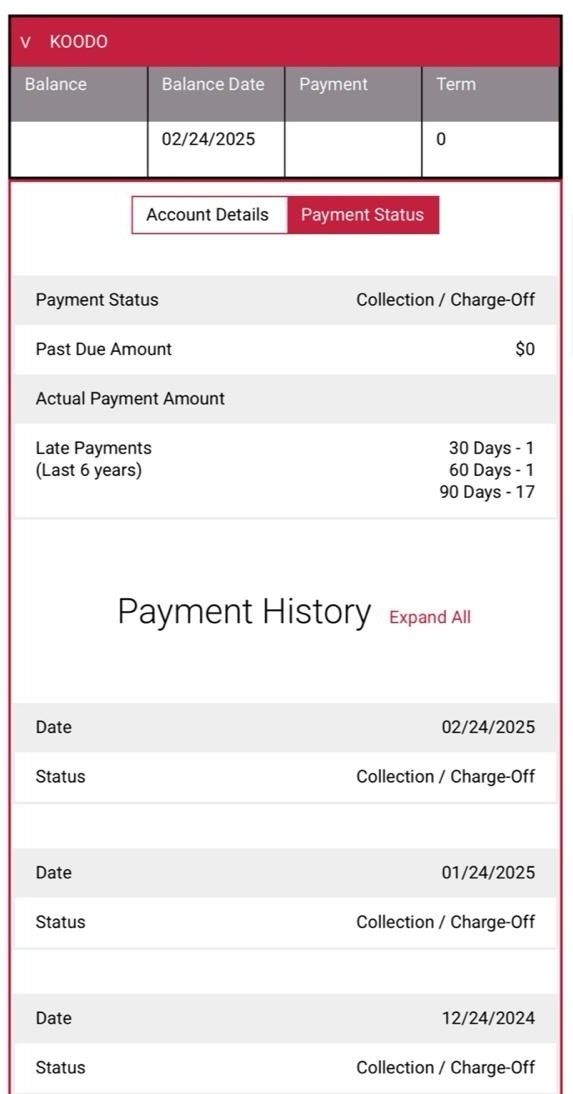

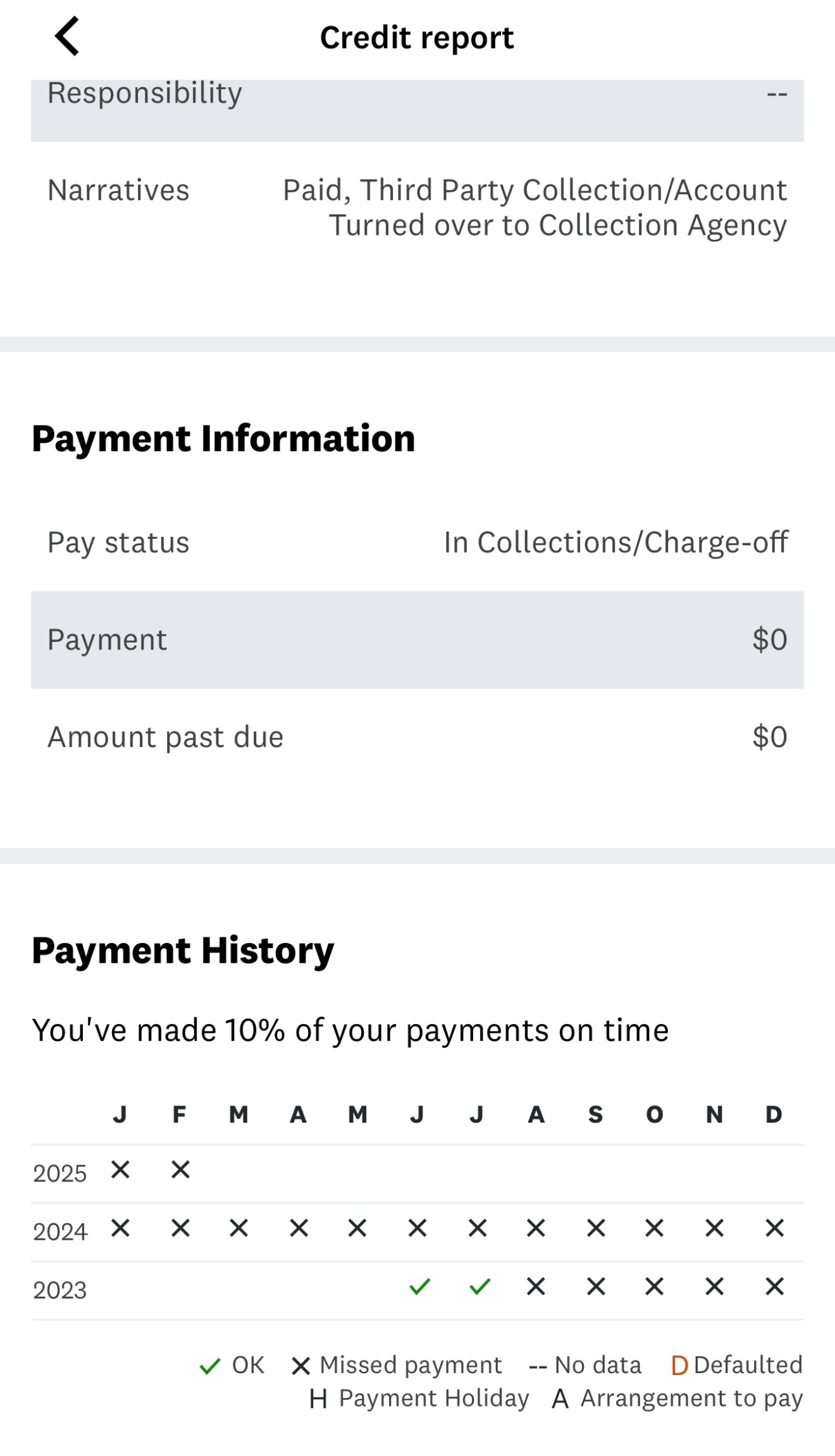

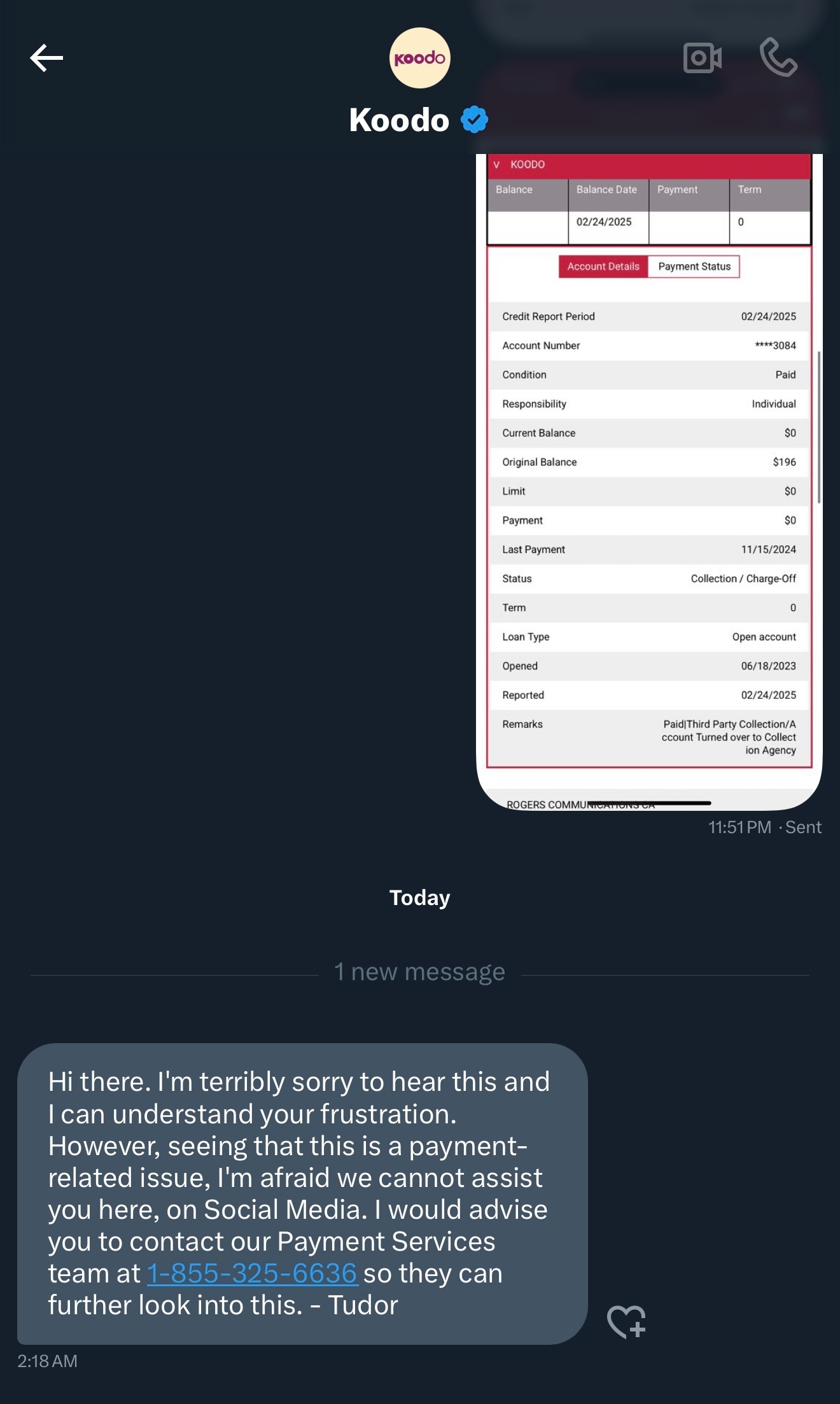

2. Koodo Is STILL Wrongfully Reporting Me to Credit Bureaus

• Despite my zero-dollar balance, Koodo is STILL reporting me as a defaulter, showing my account as “In Collections/Charge-Off.”

• This is illegal and negligent – my credit score keeps dropping because of their failure to report accurate information.

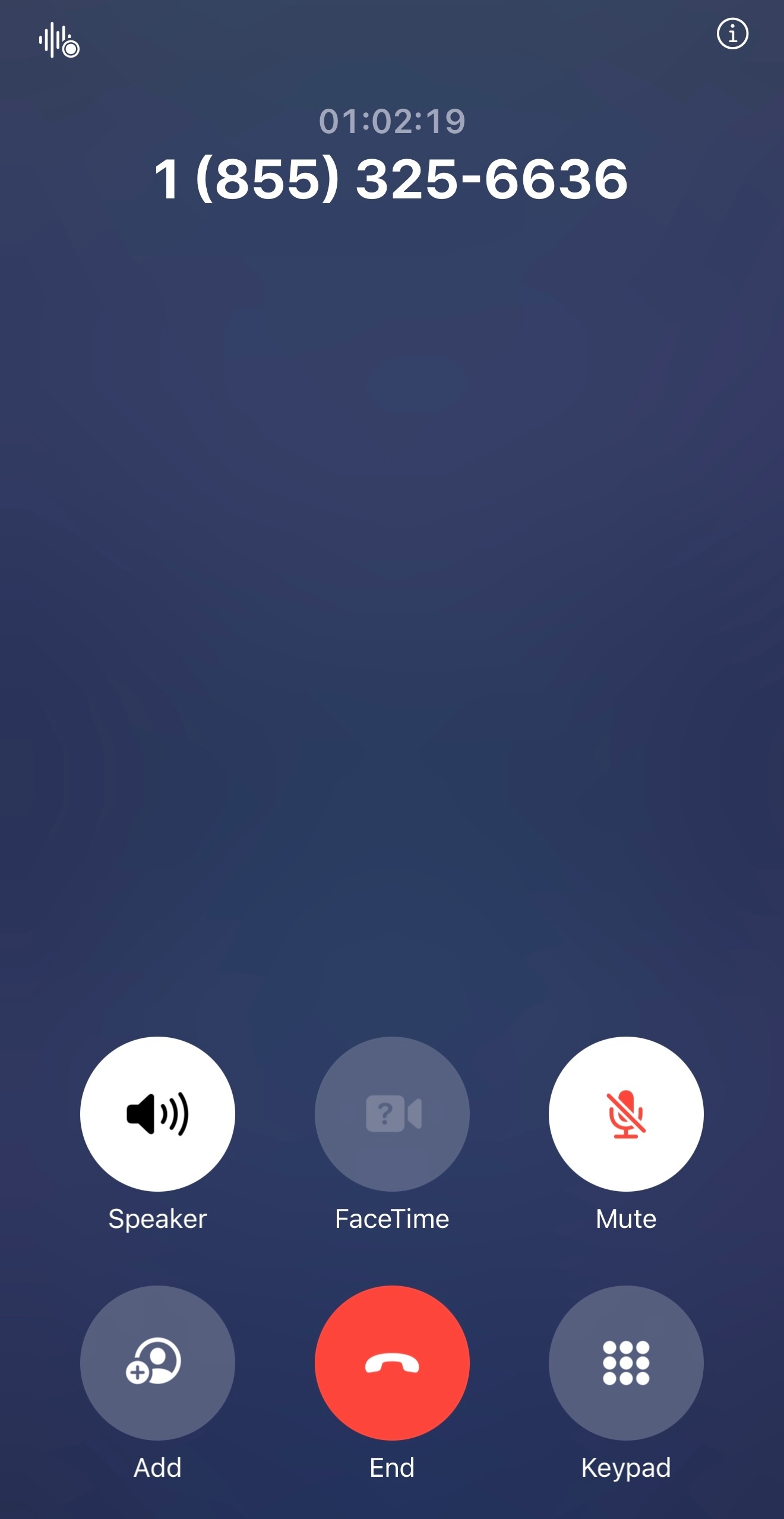

3. Koodo’s Customer Service is NON-EXISTENT

• You can’t call them – their “customer support” is a joke.

• They won’t help in-store – they literally tell you they “can’t do anything.”

• They don’t even have an email to contact!

• I have tried disputing this TWICE with TransUnion, but Koodo keeps reporting the false information.

Has anyone taken legal action against them for wrongful credit reporting? Please HELP!