Hi,

I am a former Koodo customer who used Koodo prepaid plan and ported/cancelled to different plans.

It was my understanding at that time that my account was prepaid for the full month and would have been refunded for the portion not being used. That being said, the online self serve account was also deactivated so I couldn’t check any account history/detail upon the port/cancellation.

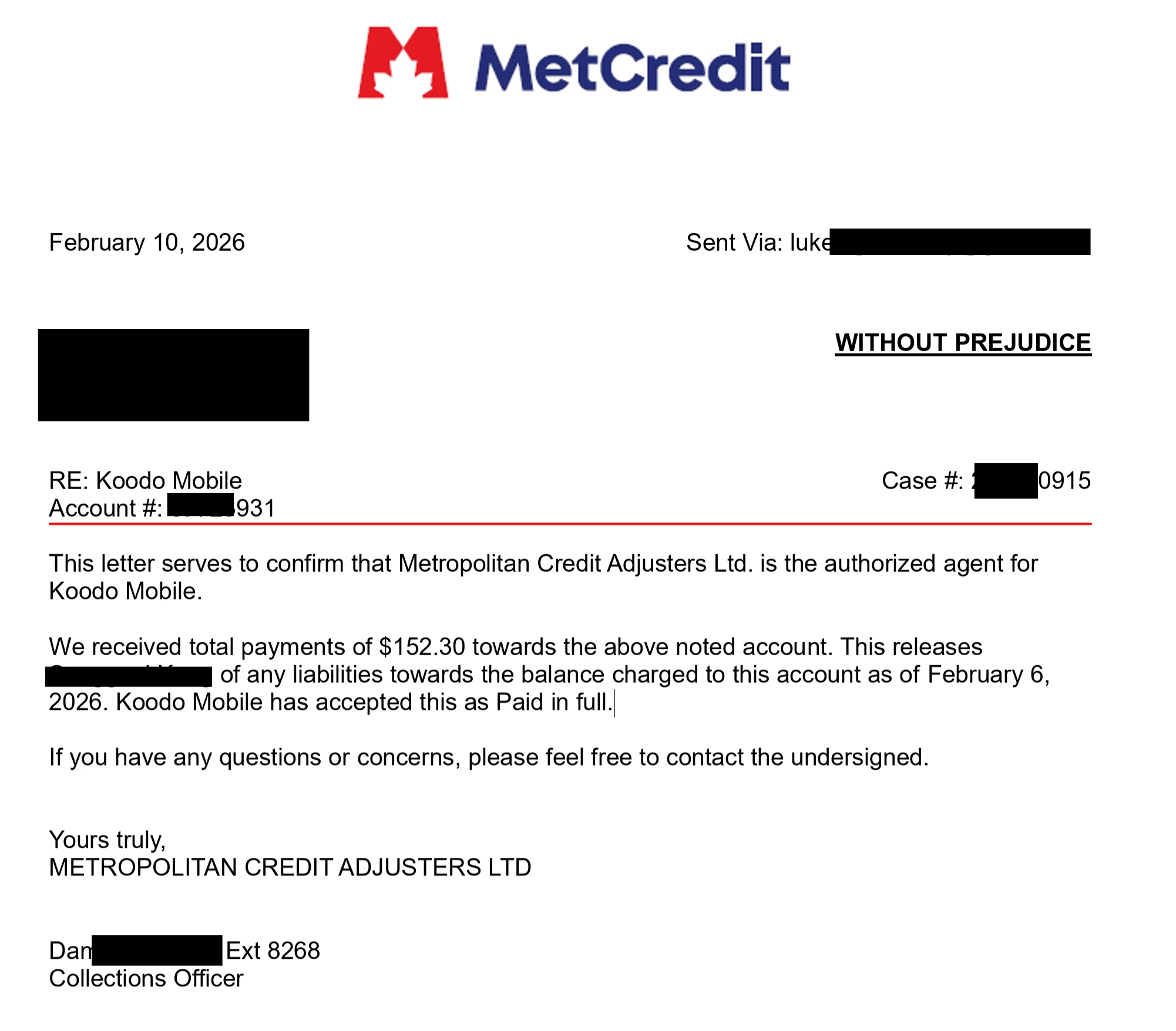

Recently, I found out that Koodo sent a $28 charge to the collections and the delinquent account has been accruing interest of 41% since then. I would like to know more details on the $28 fee and dispute the charge with Koodos since MetCredit cannot do anything other than providing settlement offer or payment option in full. Disputes have to go through Koodos according to the MetCredit agent.

I look forward to hearing back from you.

Koodo Acct #: *******1 & MetCredit #:********6

Luke K.