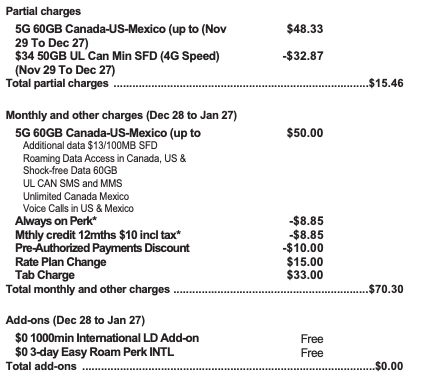

My billing cycle ends on the 27th of every month. I decided to update my phone plan from $34/month to $50/month on the 30th of November. Can someone please explain to me how Koodo charged me $15.46 for prorrated charges? My new billing cycle still ends on the 27th of every month

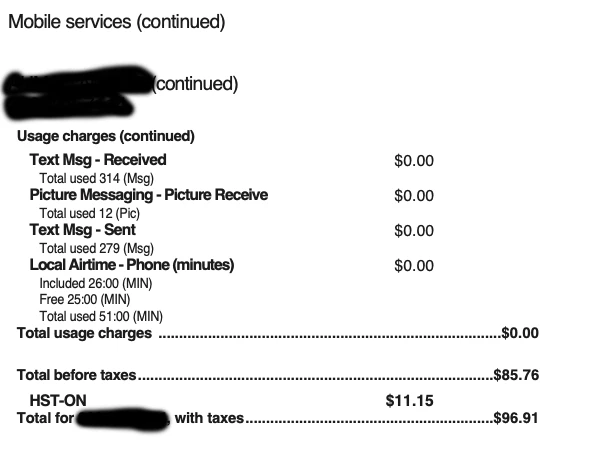

Also secondly, Koodo on their website says that $10 discounts (Always on Perk AND Monthly credit 12mnths 10 incl tax) will show up as $8.85 on the bill as $1.15 wil be deducted from the taxes. Yet they are not. 70.30 + 15.46 = $85.76 and 13% of that is $11.15 whereas the taxes should be $8.85 after the 2 x $1.15 deductions as the discounts are $10. Sounds like Koodo is not so good at math